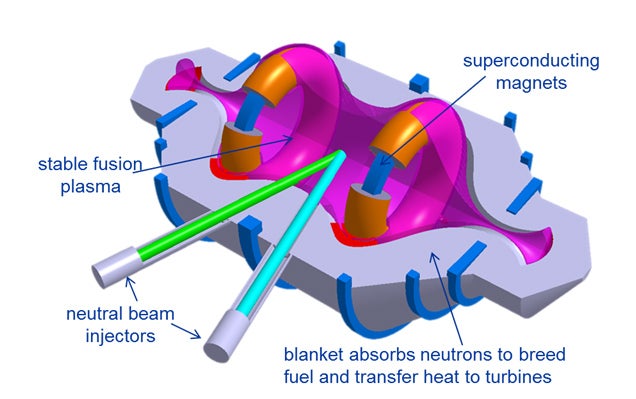

Fusion reactors. Real life has finally caught up to Sim City.

I'm excited about this from a technological standpoint, even though I don't know enough about the history of its development. The last paragraph is what caught my eye the most:

The key is the scale. This is something that can work on the scale from a large vehicle to a small city.

Modern energy development so far has always been large scale. Large scale fossil fuel plants, large scale oil delivery infrastructure, large scale nuclear power plants, large scale power grids. One of the key differences not being talked about with the changing energy landscape is how the scale is changing. Wind farms and solar farms exist, but especially for solar the major push has been for personal solar panels.

Here is something that falls in the middle. Smaller cities and larger vehicles seem to be the perfect candidate for a power source of this size.

Overall, this means that in the future there will be no magic bullet to wean us off fossil fuels. What we'll end up with is a more nuanced mix. Consider the below hypothetical situation based on medium scale fusion reactors being added to our energy mix:

In this case, you can see how this new energy mix will shuffle out. Starting at the bottom, solar energy will probably remain the most efficient way to power individual homes. More people will have the option to disconnect from the grid and become completely self sufficient on their own.

For the next step up, small towns would be at the perfect scale for Fusion Power. This setup too would allow the option of connecting to the grid. One could imagine this as homesteading on a grander scale. A community of like minded people might come together and purchase their own fusion reactor, or a development company may specialize in building small self sufficient communities for a niche market.

For large scale farming and light industrial regions, renewables become cheaper once again. In this case, wide tracts of land can double as power generation. In addition to fields of crops or out of the way warehouse locations, there can be fields of windmills or solar farms. Once again, these types of regions would have the option to plug into the power grid.

Last at the high population end of the spectrum you have large cities. These cities will have no choice but to stay connected to the grid. While efficient on a per capita basis, their density prohibits these smaller scale energy sources. They would have to source their energy from elsewhere. I use fossil fuels here in the cost curve, but of course any electric grid is going to include a mix of power sources. Until transmission and storage are improved (and if solar powered jet fuel becomes a thing, it will be,) fossil fuels are going to be most efficient at this end.

Looked at this way, one of the reasons why the fight for renewables has always been cast as big business vs little people becomes immediately apparent. Large corporations will do whatever is profitable. If renewable energy is profitable, then that is what we'll get. The problem isn't that it's not profitable, but it's not profitable at the scale that these companies currently operate at.

Read more ...

I'm excited about this from a technological standpoint, even though I don't know enough about the history of its development. The last paragraph is what caught my eye the most:

Five years after that, they expect to have a fully operative model ready to go into full-scale production, capable of generating 100MW—enough to power a large cargo ship or a 80,000-home city—and measure 23 x 42 feet, so you "could put it on a semi-trailer, similar to a small gas turbine, put it on a pad, hook it up and can be running in a few weeks."

The key is the scale. This is something that can work on the scale from a large vehicle to a small city.

Modern energy development so far has always been large scale. Large scale fossil fuel plants, large scale oil delivery infrastructure, large scale nuclear power plants, large scale power grids. One of the key differences not being talked about with the changing energy landscape is how the scale is changing. Wind farms and solar farms exist, but especially for solar the major push has been for personal solar panels.

Here is something that falls in the middle. Smaller cities and larger vehicles seem to be the perfect candidate for a power source of this size.

Overall, this means that in the future there will be no magic bullet to wean us off fossil fuels. What we'll end up with is a more nuanced mix. Consider the below hypothetical situation based on medium scale fusion reactors being added to our energy mix:

In this case, you can see how this new energy mix will shuffle out. Starting at the bottom, solar energy will probably remain the most efficient way to power individual homes. More people will have the option to disconnect from the grid and become completely self sufficient on their own.

For the next step up, small towns would be at the perfect scale for Fusion Power. This setup too would allow the option of connecting to the grid. One could imagine this as homesteading on a grander scale. A community of like minded people might come together and purchase their own fusion reactor, or a development company may specialize in building small self sufficient communities for a niche market.

For large scale farming and light industrial regions, renewables become cheaper once again. In this case, wide tracts of land can double as power generation. In addition to fields of crops or out of the way warehouse locations, there can be fields of windmills or solar farms. Once again, these types of regions would have the option to plug into the power grid.

Last at the high population end of the spectrum you have large cities. These cities will have no choice but to stay connected to the grid. While efficient on a per capita basis, their density prohibits these smaller scale energy sources. They would have to source their energy from elsewhere. I use fossil fuels here in the cost curve, but of course any electric grid is going to include a mix of power sources. Until transmission and storage are improved (and if solar powered jet fuel becomes a thing, it will be,) fossil fuels are going to be most efficient at this end.

Looked at this way, one of the reasons why the fight for renewables has always been cast as big business vs little people becomes immediately apparent. Large corporations will do whatever is profitable. If renewable energy is profitable, then that is what we'll get. The problem isn't that it's not profitable, but it's not profitable at the scale that these companies currently operate at.